Digitized Everyday Transactions with STC Pay’s Mobile Wallet

STC Pay Bahrain, a subsidiary of Saudi Telecom Company Group, is a licensed digital wallet provider regulated by the Central Bank of Bahrain. The platform enables secure money transfers, payments, and financial transactions, supporting the country’s shift towards a cashless economy. As part of its expansion strategy, STC Pay sought to enhance its digital wallet platform by incorporating advanced features.

$50M+ in total transaction volume processed

12% growth in user base

Bahrain

Nov 2022 - Present

Financial services, Banking

Services Used:

“Collaborating with team Code District was a great experience. They brought deep technical expertise and a problem-solving mindset to the development of our digital wallet platform. Their ability to integrate complex financial services while ensuring security and usability made a significant impact.”

Head Of IT, STCPay Bahrain

The Challenges

As STC Pay expanded its offerings, it encountered several technical and operational challenges that needed to be addressed to ensure scalability, security, and regulatory compliance.

-

Complex Financial Integrations

STC Pay needed to integrate with multiple financial institutions, banks, and telecom operators to support seamless fund transfers, bill payments, and mobile top-ups. The challenge was ensuring secure, real-time transactions across different financial networks while maintaining a consistent user experience. The system had to support peer-to-peer transfers, international remittance services, and payments to telecom companies, requiring robust API integrations.

-

Strict Banking Security and Regulatory Compliance

As a licensed financial services provider, STC Pay had to comply with strict security and regulatory requirements imposed by the Central Bank of Bahrain and international financial regulators. The platform required end-to-end encryption for transactions and other security protocols for user’s data security, and fraud detection mechanisms to mitigate risks. Ensuring anti-money laundering (AML) compliance was critical for onboarding users while preventing fraudulent transactions.

-

Optimizing User Experience for Seamless Transactions

With a growing user base, STC Pay needed a highly intuitive and user-friendly platform that allowed customers to transfer funds, pay bills, and top up accounts with minimal friction. The challenge was ensuring real-time transaction processing, seamless navigation, instant notifications, and transaction tracking while handling increasing traffic efficiently.

-

Lack of Scalable Digital Wallet Infrastructure

To support millions of financial transactions, the platform required a scalable backend architecture that could manage high transaction volumes without delays. The middleware had to facilitate smooth communication between banking networks and financial services, ensuring low latency, high availability, and system reliability to prevent service disruptions.

Solution

To overcome these challenges, we designed and developed a highly secure, scalable, and feature-rich digital wallet platform, providing STC Pay with advanced financial integrations, enhanced security, and an optimized user experience.

Get the full case studyScalable Digital Wallet System

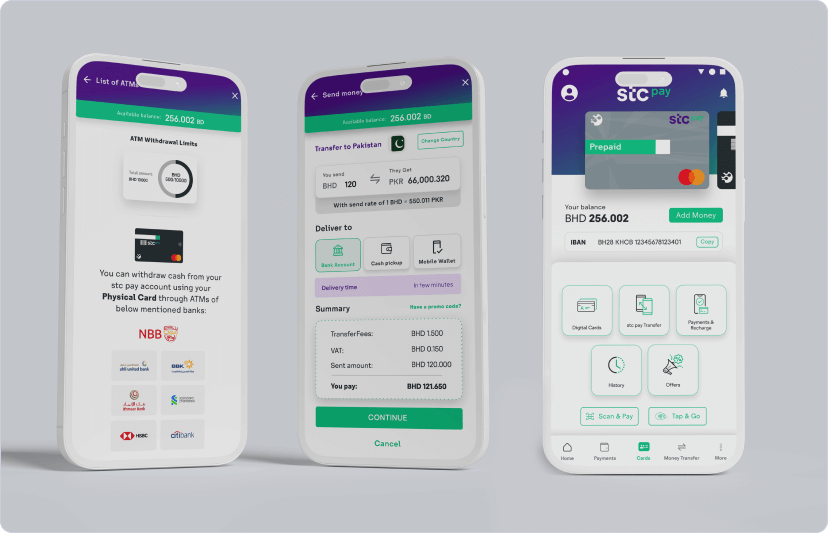

We developed native mobile applications for Android and iOS to provide a fast, reliable, and intuitive user experience. Alongside, we built a secure and scalable web-based application using ASP.Net with .NET Framework 4.8, designed to handle high transaction volumes and support future feature expansion. The architecture ensures smooth integration with external services, robust performance under load, and flexibility for ongoing growth.

Multi-Service Financial Integrations

The platform was integrated with Khaleeji Commercial Bank Bahrain to facilitate secure bank transfers and IBAN issuance after completing the KYC process. Peer-to-peer transactions enabled instant transfers between STC Pay users, while Fawri and Fawri+ integrations allowed customers to send money using a mobile number or IBAN. For international transfers, the platform connected with Transfast and Hello Paisa, providing users with the best foreign exchange (Fx) rates for over 40 countries.

Security and Compliance Enhancements

To meet financial security standards, we implemented end-to-end encryption, real-time fraud detection, and multi-factor authentication (MFA) for secure user verification. The KYC process was automated through integration with Benefit, Bahrain’s financial compliance authority, ensuring identity verification and risk mitigation. Additionally, role-based access controls and transaction monitoring helped prevent unauthorized access and suspicious activities.

Optimized User Experience and Transaction Efficiency

A mobile-first UI/UX design was introduced to ensure seamless navigation and transaction processing. Users could send money, pay bills, and top up mobile accounts with just a few taps. Push notifications and instant transaction tracking provided transparency and security while ensuring a smooth payment experience. The system also introduced a marketplace module for purchasing digital gift cards and international mobile top-ups, integrated with Ding and Mintroute.

Advanced Admin Panel and Monitoring

A comprehensive web-based admin panel was developed to monitor transactions, manage customer accounts, and configure service charges. This internal system allowed different user roles, such as admins, customer care representatives, and compliance officers, to track transactions, set fee margins, configure Fx rates, and monitor fraudulent activity in real time.

Wage Protection System (WPS) for Payroll Management

One of the key modules developed was the Wage Protection System (WPS), designed for employee salary management. Employers could register their companies, add employees, process payroll, and manage bonuses and incentives through an intuitive portal. This system ensured regulatory compliance, financial transparency, and efficient payroll distribution across various organizations.

Development of Remittance Module

To further enhance its financial offerings, STC Pay expanded its remittance services. We developed a secure, scalable cross-border money transfer system that ensures secure international fund transfers with real-time exchange rate tracking, anti-money laundering (AML) compliance to detect and prevent illegal transactions, and seamless integration with international banking networks for enhanced coverage

The Results

increase in in-app transactions

growth in user base

increase in customer satisfaction

in total transaction volume processed

in international remittances

faster transaction processing speed

faster KYC verification process

Technology Stack

Share your business goals with technical experts

Sales and general inquires

sales@codedistrict.comCall us

+1 (703) 940-1971“Code District successfully launched our application on time. The team worked hard, adjusted to our schedule, and ensured our requests were turned around very quickly. They asked the right questions, used sound judgment, and made consistent progress, demonstrating strong technical skills and a driven attitude.”